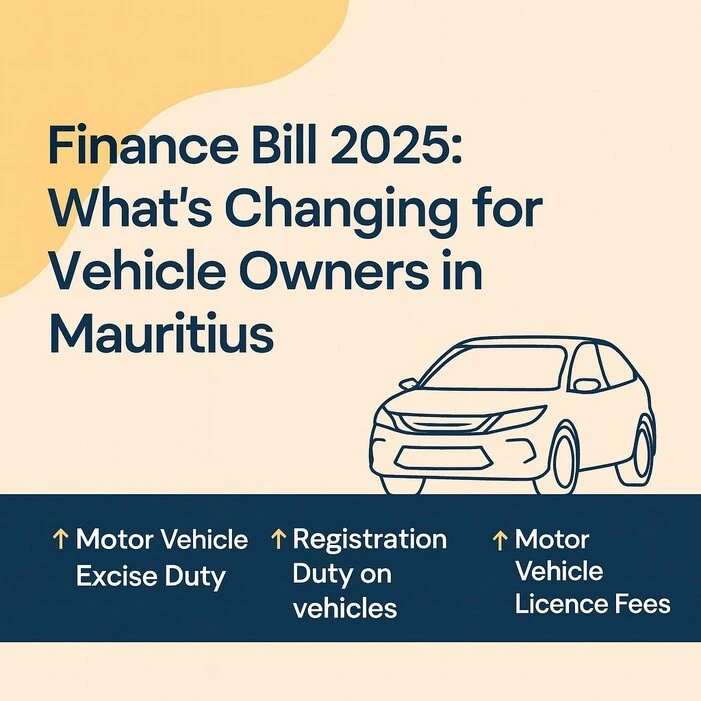

Finance Bill 2025: What’s Changing for Vehicle Owners in Mauritius

The Finance Bill 2025 has officially been released, and for anyone thinking about buying, selling or owning a car in Mauritius, there are several key updates to take note of. From new excise duty rates to changes in registration fees, here’s a clear breakdown of what’s changing from June and July 2025. From 6 June 2025, new excise duty rates apply based on engine size and vehicle type. Here's how it breaks down: Electric vehicles now face a tiered excise duty system: 15% for EVs up to 180kW 25% for EVs above 180kW From 1 July 2025, two major changes come into effect: Registration duty on domestic pre-owned vehicles has been abolished, making used cars more financially appealing. Registration duty on new vehicles has increased by 30%, affecting both dealers and importers. The 50% discount on licence fees for hybrid and electric vehicles is now cancelled. This means all vehicle owners, regardless of fuel type, will pay the standard rate. However, flexible payment plans are still available, including 3-month and 6-month options. These updates signal a shift toward a more balanced approach to taxation, encouraging cleaner technologies without overly subsidising them. Buyers of used vehicles stand to benefit most, while those eyeing new conventional cars or high-powered EVs may feel the pinch. Whether you're browsing for your next vehicle or selling your current one, AutoCloud can help you stay informed and connected. Visit AutoCloud.mu to explore your options and make smart automotive choices in this new tax landscape.Updated Excise Duty on Motor Vehicles

Changes to Registration Duty

Motor Vehicle Licence Fees

What This Means for You

More Articles

![AutoCloud Driven: Jetour X70 Plus]()

AutoCloud Driven: Jetour X70 Plus

There's a moment, just before you turn the key, when a car either earns your attention or loses it. Standing ...Read more![A tougher stance on drink and drug driving in Mauritius, but will it actually help?]()

A tougher stance on drink and drug driving in Mauritius, ...

Mauritius has started 2026 with a worrying spike in drink and drug driving cases, and Government is moving towards a firmer ...Read more![An opinion on modern car features we probably did not need]()

An opinion on modern car features we probably did not ...

This is an opinion piece. It is not an argument against modern cars, nor an attempt to discourage the purchase ...Read more